Pandenomics: Why The Stock Market Took Off When The World Shut Down

The greatest stock market rally in history coincides with the worst economic crash since the Great Depression — what gives?

From February 19 to March 23, 2020, the US stock market saw its fastest crash ever with a 34% loss on the S&P 500. Then, on a knife point, Wall Street staged its best 3-day rally since the Great Depression. As of May 1, the market has recovered 30% from its dip. Meanwhile Main Street steadily worsened with over 30 million Americans out of a job.

Well, at least they’re going in the same direction.

This, by itself, isn’t surprising, because the market is future looking and reacts to uncertainty rather than bad news. But my thinking around this changed after reading investment memos from Howard Marks, the chairman of Oaktree Capital and Charlie Munger, Warren Buffett’s partner. The contrast between the worried voices of these two respected investors’ and the confidence at which the market was moving piqued my curiosity, so I started digging.

What I discovered was a great disconnect between investor (and hence market) expectations and reality. I was astonished to realize that the best stock market rally of the past century was based on extreme investor confidence in what appeared to be very fragile evidence.

By the time you finish reading this, you’ll have learned:

What caused the great market crash?

How has the government intervened, focusing especially on the Federal Reserve (The Fed)?

What boosted the extreme market rebound?

Why is investor confidence so fragile?

What’s next?

Take a deep breath. Let’s dive.

🎩 Quick Note: You’ll notice the term Mr. Market being used. It’s used to symbolize the stock market and comes from Benjamin Graham’s 1949 classic, The Intelligent Investor. Graham was Warren Buffett’s mentor, and he used Mr. Market as a hypothetical investor who’s usually rational but also prone to panic, euphoria and FOMO (fear of missing out). Because the market is made up of human investors like MM, the market as a whole adopts these qualities.

📺 Videos: If you prefer listening/watching over reading, check out the abridged version in two Youtube episodes here and here.

Act I: The Crash

Run on banks during the Great Depression

First, we need backup to why the market crashed in the first place to better understand what Mr. Market dreads. When the possibility of a national shut down and freezing of the economy became probable, it presented some huge uncertainties around just how deep of a recession we could go. The biggest fears were:

Unemployment: If Covid forces the government to lockdown the nation and put the economy on ice, it would stop the flow of money from buyers to sellers on a massive scale. Without revenue, companies would downsize and layoff employees, causing a huge spike in unemployment. Depending on how long unemployment lasts, people can come out of the lockdown without savings and with a negative outlook of the future, leading to less spending and borrowing money, which in turn slows down economic activity and recovery.

Liquidity crisis: Liquidity refers to how easily an asset or security can be converted into cash. At the heart of this is the ability of companies and individuals to raise cash by taking on debt in the form of credit. A liquidity crisis arises when people make a run on banks to meet short term financial obligations and survive an economic downturn. During this period of heightened demand for cash, banks hit their reserve limits and run out of capital to loan. And because so many non-financial businesses rely on cash from short term loans to meet their short term payments, it causes a ripple effect across the entire system as other businesses can’t get paid. If the economy were a person, then cash is the blood, the banks are the heart, and a liquidity crisis is a heart attack.

Defaults and bankruptcies: This ripple effect can cause bankruptcies and defaults on loans. If a company is going into this recession highly leveraged, that is with a lot of debt, and defaults on those loans, it damages the financial system further because banks can’t recoup the capital they lent out. And if companies run out of cash because either they can’t borrow or get paid by their customers, they go bankrupt. The longer this cascade of defaults and bankruptcies continue, the harder it is to recover as people won’t have a company to go back to work to after the lockdown ends.

The possibility of this scenario happening ripped through the investor community in short order. Mr. Market, who always uses past data to inform his vision of the future, suddenly had no prior experience with a pandemic-caused seizure of the economy.

Mr. Market, who always uses past data to inform his vision of the future, suddenly had no prior experience with a pandemic-caused seizure of the economy.

He was staring into the abyss.

And what does the abyss look like? Our best example of the worst-case scenario is the Great Depression (1929–1933) when the quantity of goods and services (i.e. real economic productivity) of the US fell by a third, unemployment grew to 25%, about 7,000 banks failed and the stock market lost 80% of its value.

Mr. Market had good reasons to panic

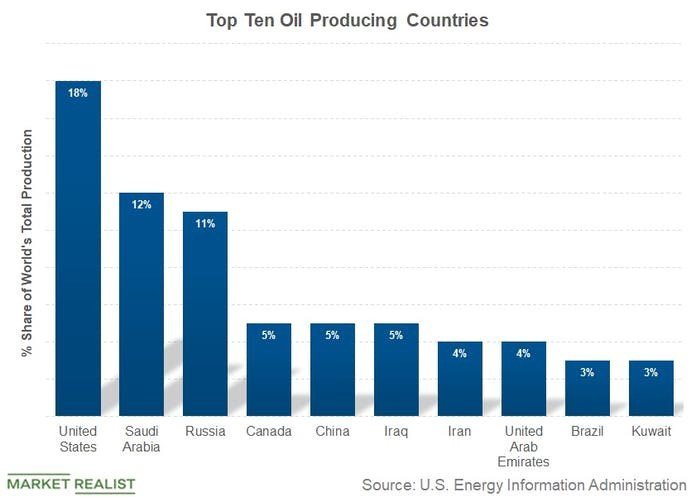

🛢️Quick Note about Oil: One other major contributor to the market crash was the oil price war between Saudi Arabia and Russia in March. I won’t go into too much detail on that since we’re mainly focused on Covid-related impacts. For now, just note that the US has become the largest oil producer in the world since 2018. Our economy is very exposed to a simultaneous oil price war and sudden drop in global oil demand, which caused the biggest oil price decline in the past 60 years. I’ll explain how this affects economic recovery later.

US is the world’s largest oil producer, making its economy especially vulnerable to oil price fluctuations

Act II: The Cavalry

This is where the government entered from left stage. And they brought bazookas.

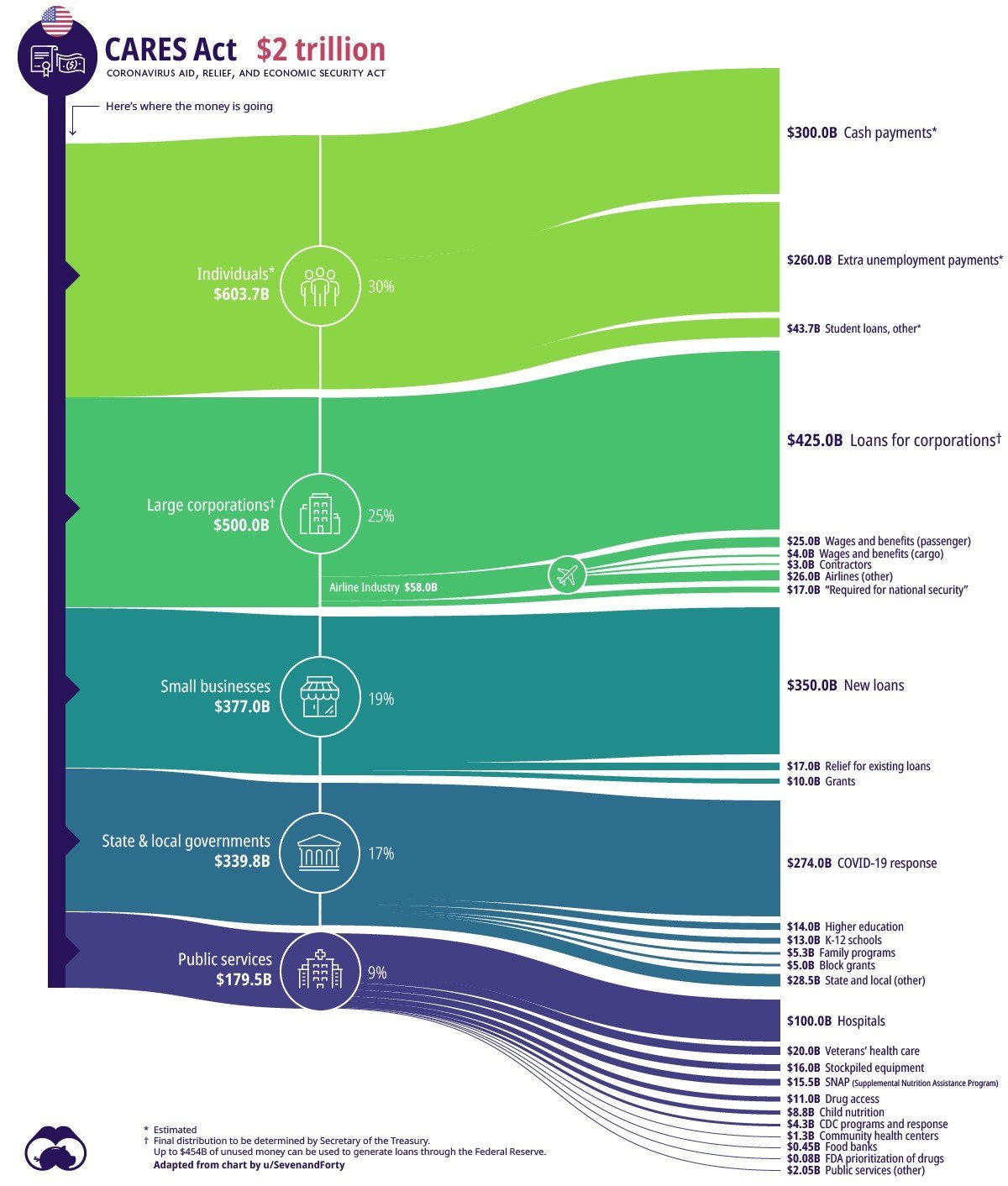

I won’t dwell on the CARES Act, given the media attention around it. In fact, its direct impact on the markets pales in comparison to what the Fed has done. All Mr. Market wants to know from Congress and the Treasury is that Main Street is taken care of, so that people can go back to work and are still in the mood to spend money once the world starts turning again. What I will cover briefly is the rationale behind the monstrous size of the stimulus package.

The “stimulus” package is more like a simulation of a working economy while everything’s frozen to prevent us from falling into a depression.

The “stimulus” package is more like a simulation of a working economy while everything’s frozen to prevent us from falling into a depression. It’s designed to directly counterbalance a 3-month (i.e. one business quarter) economic shock. It’s estimated that a national lockdown would crater the quarterly GDP by up to 30%, about $2 trillion, which is the roughly same size as the package.

Looking at it another way, the total labor compensation in the last quarter was $2.9 trillion and in a worst-case scenario of 20% unemployment, about $580 billion of wages, which is very close to the $600 billion carve out for individuals. Both the estimated GDP and unemployment damage are comparable to that of the Great Depression, indicating policy makers had geared up for the worst-case scenario.

Source: VisualCapitalist

From the Fed, we’ve got well…an unlimited supply of money.

The Fed traditionally controls the market by lowering interest rates to encourage businesses to borrow and investors to seek higher returns in the market rather than keeping it in US Treasury notes and bonds (called treasurys). The Fed can also pump money into the market by buying up treasurys and mortgage-backed securities.

And that’s exactly what the Fed did when it dropped the interest rate to near zero and started buying securities for a mind-blowing $125 billion a day during the first week of the CARES Act. To put this into perspective, the Fed was buying more in one day than it bought in an entire month during the Global Financial Crisis. This has since slowed to $40 billion worth of assets a day, but it’s still a staggering amount.

If the pace and magnitude of the Fed’s buying spree wasn’t shocking enough, it’s also expanded its range of powers to inject money in many more places. The Fed is normally only allowed to buy government-backed debt, but by invoking section 13(3) of the Federal Reserve Act, it can transform into a financial Superman and lend to riskier areas of the economy through a special purpose vehicle or SPV.

Here are the very abbreviated description of the main programs (called “facilities”):

Commercial Paper Funding Facility (CPFF): Lending to companies by buying commercial paper or CP. CP a form of unsecured short term debt that companies issue sell to raise cash to meet payroll and other accounts payable due typically within 30–90 days. The ability for companies to issue CP to get working capital is essential to the flow of money and liquidity.

Money Market Mutual Fund Liquidity Facility (MMLF): Lending to financial institutions that buy CPs. There’s a bit more to this, but ultimately it allows for more ways for companies to sell CP, and hence increasing liquidity.

Primary Market Corporate Credit Facility (PMCCF): Lending to companies by buying up investment grade corporate bonds and helping investors sell these bonds in secondary markets through the Secondary Market Corporate Credit Facility (SMCCF).

Primary Dealer Credit Facility (PDCF): Lending to primary dealers of the New York Fed. These primary lenders are banks and other financial institutions that deal directly with the government and can use the Fed’s money to buy up a wide range of securities including corporate debt, CP, municipal securities, and even equity securities aka company stocks. Additionally, the program can continue for as long as needed.

PDCF is one of the most open-ended of the Fed’s programs and could turn into one of the most controversial depending on who it bails out.

FX Swap Lines: Make US dollars available to foreign central banks to increase global liquidity. The Fed is the global central bank because 70% of transactions (buying, selling, savings, debt etc) in the world is in dollars, and what’s happening in the US is happening everywhere. Therefore, The Fed needs to provide enough dollars to keep other economies flowing.

The Fed has the hefty responsibility of maintaining global liquidity during an economic crisis

Most of these programs were directly taken from the Global Financial Crisis playbook, just at a much larger magnitude. The Fed is even bailing out city and state governments and buying up the junk bonds of companies with poor financials.

Junk bonds, or officially known as high-yield bonds, are so-called because they’re issued by companies who are more likely to default on them. In the world of security ratings, junk bonds are rated BB and below. For now the Fed has limited its purchases to bonds rated BB, which is the best of the junk, aiming to bail out companies that were downgraded only recently because of the crisis. Still, this is an unprecedented move that caused a rally in junk bond markets and generated plenty of fun headlines.

ETFs that track junk bond prices spiked on April 9, the day the Fed announced it would buy BB bonds

As you can imagine, there’s potential for moral hazards to be created because the Fed’s broad strokes could bail out businesses that took on too much debt during good times and now burning during the bad. This introduces all sorts of distorted incentives in a free market system. As Howard Marks eloquently put it:

“Capitalism without bankruptcy is like Catholicism without hell.”

This monetary rocket ship was built and launched in a single week while it took the Fed several months to patch it together in 2008. The reassuring presence of Super-Fed plugging financial holes is the key reason Mr. Market feels so safe.

Safe enough, in fact, to go on a record-breaking shopping spree.

Act III: The Stampede

With the government providing a stable ground for everyone to stand on and market value down by a third, investors felt detoxed and optimistic enough to get back in the game. And they weren’t just easing in slowly. It was a stampede.

If a negative outlook and uncertainty drives investor fear, then certainty and a positive outlook drives investor optimism. The extreme rebound suggests that Mr. Market was very certain about a bright future. So where did this confidence coming from?

It’s based on a few assumptions:

1. The government’s aid will be effective in sustaining the frozen economy while Covid is being contained. One promising sign is that the banks are strong this time compared to 2008. In the 2019 annual stress test conducted by the Fed, the major US banks have enough capital to absorb a 10% unemployment rate, 8% real GDP loss, a 50% drop in the stock market, 25% drop in residential real estate, and 35% hit to commercial real estate — while continuing to pay dividends. Combined with the massive government support, the heart of the economy is at least in good health.

Source: CSSE at John Hopkins University

2. The virus will be contained within 3 months or so. This means the curve will flatten until there are no more new cases. Remember that the market is forward looking, deriving its foresight by extrapolating past data. So if everything about this pandemic is unprecedented, then where are investors getting this past data? We don’t have to look too far back because the market is actually using the latest data from other countries like China and South Korea, which show roughly 6-weeks to peak followed by declines in new cases.

Based on this pattern, Mr. Market is expecting the US to peak between mid-April and May with the economy revving up by June. Not only are investors expecting the US to follow China’s example, but also expect the rest of the global economy to do the same.

3. The recovery will be as sharp as the drop. You might have heard of the term “V-shaped recovery”. Since there’s no historical data on this, investors have to rely on the very recent past. So far the only major economy that’s recovered in this fashion is China. Specifically, investors are taking positive cues from the very surprising V-shaped bounce of China’s Purchasing Manager’s Index (PMI) and extrapolating it to the rest of the world’s economies.

The PMI is a measure of the direction of economic activity based on a monthly survey to key industries

These are the main reasons for the optimism, but it’s hard to believe that every investor can be that confident about the future. To explain the stampede of bulls that occurred, we have to bring in FOMO.

Have you ever been pressured into going to a party because you were afraid to miss out on all the fun your friends might have? Investors are the same. You don’t have to get the majority of investors to be optimistic, just enough to convince the people sitting on the sidelines. This positive future bias becomes baked into stock prices once enough wealth is tied to the recovery of the market.

From here on, daily news becomes either a validation or invalidation of this hope. Any positive news like a reduction in cases or promising new treatments will make Mr. Market do a little jump. Any negative news like unemployment numbers and poor quarterly earnings will bring him slightly down. But overall he’s in a good mood.

That is, until something comes along to shatter his hopes and make him uncertain again.

Act IV: Headwinds of Uncertainty

It might not take much to shatter Mr. Market’s hopes. All we have to do is question the same assumptions that made him confident.

1. State of the healthcare crisis. Since both the pandemic duration and the recovery rate are extrapolated from a single data point in the immediate past, that is China, investors are standing on thin ice. Furthermore, this single data point isn’t exactly representative of the US scenario, much less the global economy at large.

First, the Chinese government clamped down the Covid hotspots with an iron fist while mandating a nationwide extended Lunar New Year holiday. We just can’t do this in a federal republic like the US, so the response has been spotty, relying on state and local action. This leads to the second point: the pandemic never became as pervasive in China as it is now with the rest of the world.

Infection hotspots from John Hopkins data

Recovery will be staggered because every state and locality has a different curve and very different attitudes towards the pandemic. California, for example, is waiting for testing capacity to pick up before making a concrete plan. Whereas Georgia, which according to the latest IHME models should wait until June 8 at the earliest, has already reopened nonessential businesses.

Institute for Health Metrics and Evaluation, University of Washington in Seattle projections as of April 22, 2020

2. Effectiveness of the government response. There’s no doubt that the government is pulling all the stops to keep the economy alive while dealing with the pandemic. But how weakened it gets during this process is anyone’s guess. Just because the size of the aid matches the magnitude of the damage on paper, doesn’t mean it’ll magically apply itself exactly where it’s needed.

Policy is a blunt instrument whereas the economy’s workings are complex and intricate beyond anyone’s full understanding. This means all the government can do is to continue to hammer more money into its sick patient until the disease is contained enough to resuscitate him.

Policy is a blunt instrument whereas the economy’s workings are complex and intricate beyond anyone’s full understanding.

This is exactly what happened when the initial $350 billion Paycheck Protection Program (PPP) ran out, and now another $310 billion is being injected. In the meantime, for every dollar that gets misallocated and for every day that payments to at-risk recipients are delayed, more businesses will fail and a speedy recovery becomes more uncertain.

Here are a few other factors to consider:

US consumer spending is 70% of the country’s GDP and even larger than the entire GDP of China, so a strong recovery will heavily depend on how people feel about loosening their wallets after the lockdown.

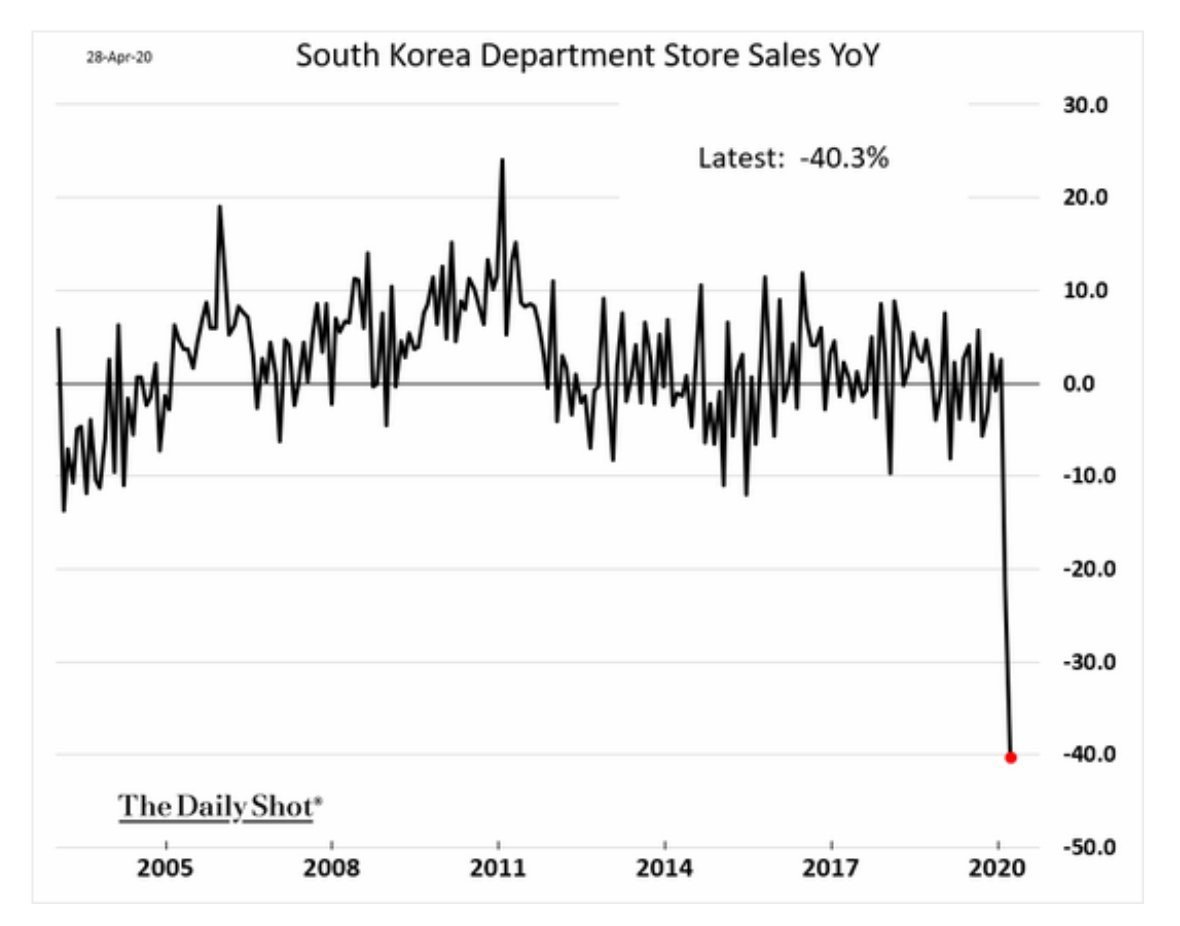

Even if shelter in place were lifted across the country tomorrow, industries like movie theaters, travel, retail, and restaurants will likely have a slower recovery as people deal with their fear of infection. If the market is optimistic because China’s PMI (which is mostly based on the sentiment of manufacturing managers) bounced back, perhaps we should look at what’s actually happening to consumer behavior there.

Discretionary (i.e. non-essentials) spending is still down 40% two months after China’s curve flattened. And it’s not just China — South Korea is seeing the same -40% trend in its department stores. This indicates that while the government can prop up the economy, it’s hard to change personal choices about going to public places.

Furthermore, the pent up demand that some investors are relying on may well be exhausted by the time lockdowns are lifted, especially if people have burned through their savings, can’t find jobs, or have a negative future outlook. Unemployment will be an especially acute and chronic economic headwind as certain industries will take a while to recuperate.

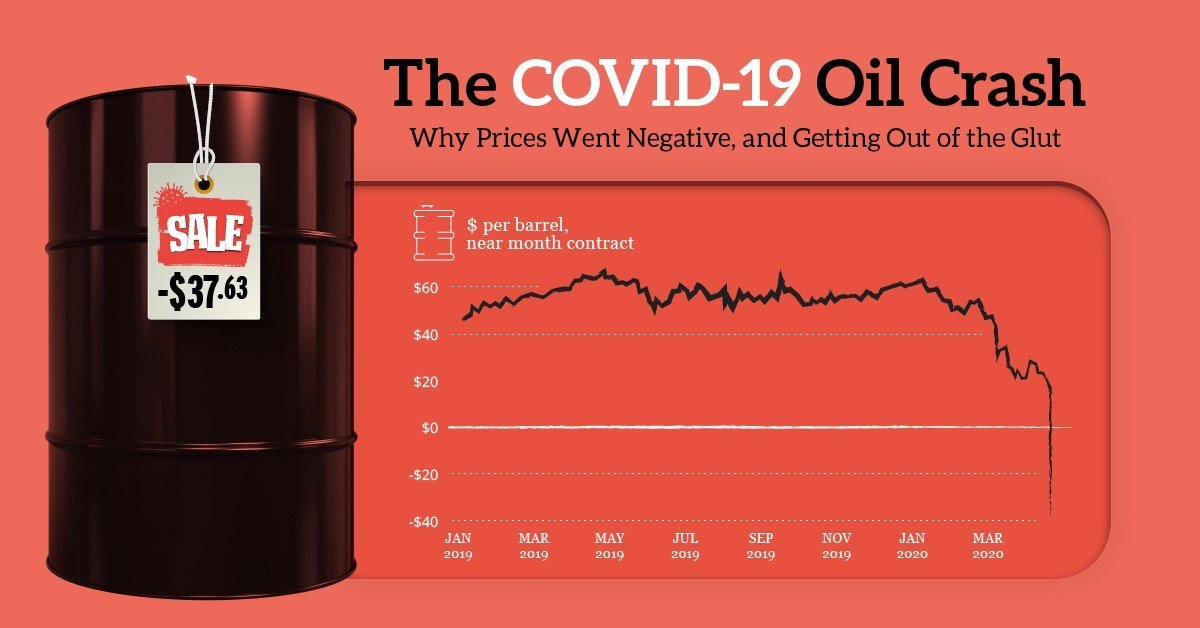

There’s one other elephant in the room: oil. The energy sector is responsible for over 5% of American employment, about 8 million jobs, as well as an important source of revenue for the country. Thanks to the fallout of oil prices from a double whammy of the Saudi-Russia price war and a Covid-induced consumption drop, the oil industry is taking a huge beating and could go into a debt default cycle, laying off people as it contracts. Recovery of this sector could also face other challenges. Oil reservoirs in particular can’t be switched off and on without taking damage that risk billions of dollars in capital investment and permanent loss of the resource.

The oil sector is really taking a beating, taking jobs and earnings with it. Source: VisualCapitalist

This is by no means a definitive list of factors, but it demonstrates just how uncertain we are of the rapid recovery that the market is counting on.

We’re going to get through this

If you’re depressed after reading this, don’t be. While a lot has happened, the reality is that we’re still in the early phases of this story, and probably the most painful chapter. But as Warren Buffett proclaimed in this year’s Berkshire Hathaway shareholder meeting: “Never bet against America.”

“Never bet against America.”

-Warren Buffett

I share his sentiment. The world has faced worse crises and grown more prosperous after each episode. Soon we will all get back on our feet and face the looming presence of Covid-19 in our daily lives. It will test our patience and it will test our character. But we will get through this, and become stronger for it in the long run.

Thank you for reading. If you want to hear more, follow me here on Medium or subscribe to my Youtube channel where I publish a weekly video about topics like this, structured thinking and problem solving, interviews, and book reviews.

As a final note, none of this is meant to be investment counsel. My goal is to use an exceptional event to illustrate some fundamental workings of the economy and markets, similar to how economists study the Great Depression and Global Financial Crisis.

However, if you are considering investing in this climate, remember these two pieces of classic advice: 1) don’t fight the Fed (as we’ve seen, the Fed can easily defy the logic of a free market, Matrix style — we’re in an economic simulation after all!) and 2) the market can remain irrational longer than you can remain solvent. I’ll throw a third one in for Buffett: “never bet against America” :)