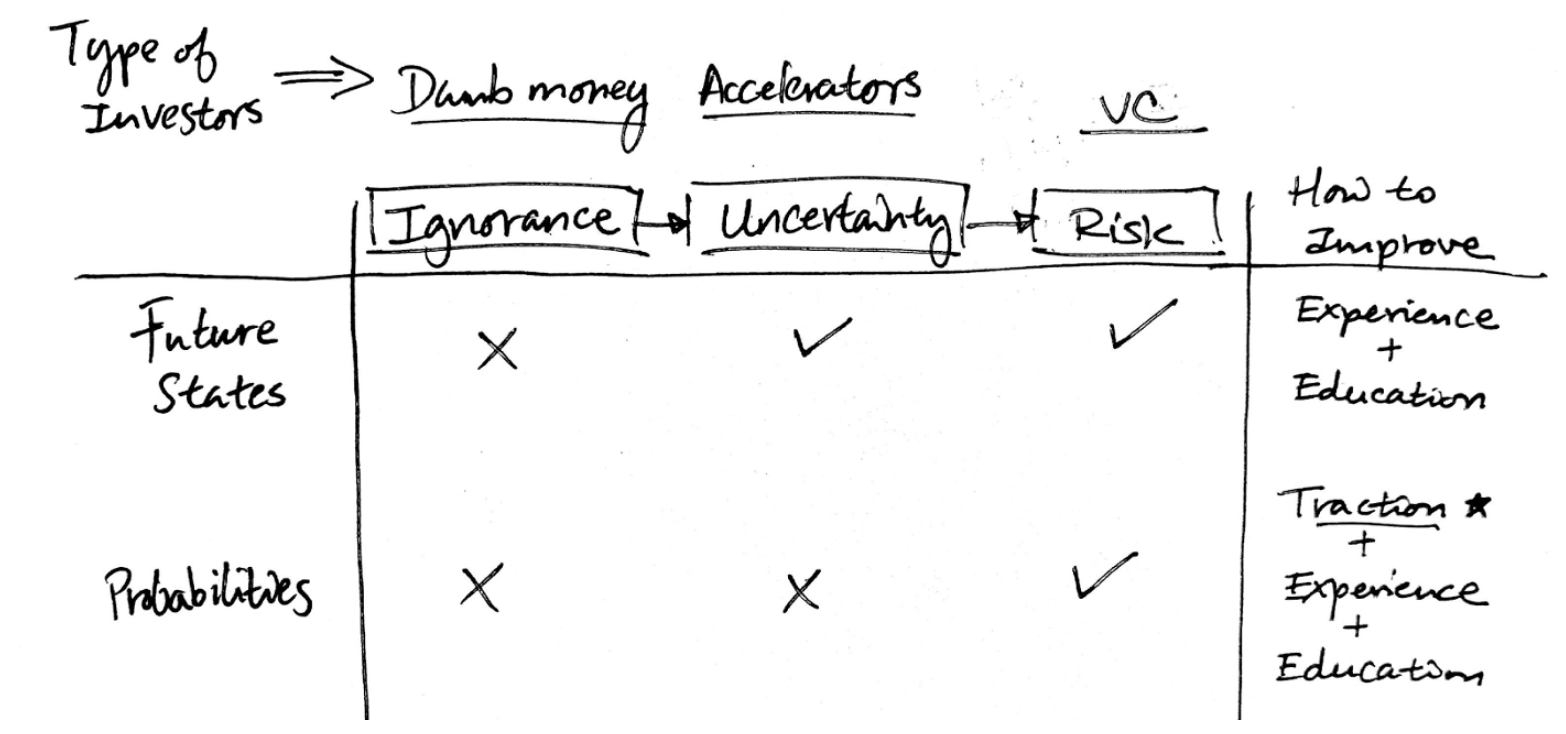

Ignorance, Uncertainty, and Risk in Venture Investing

Everyone knows that startup investing is risky business. But what exactly is “risk”? Economist Frank Knight classifies uncertainty and risk in this framework:

Ignorance: you don’t know the future states nor their probabilities.

Uncertainty: you know the future states, but not the probabilities.

Risk: you know both future and their probabilities.

In the startup investing context it looks something like this:

Type of Investors: These are the types of investors (at the risk of oversimplifying) you’ll likely to encounter across the spectrum from ignorance to risk:

“Dumb money” operates on ignorance without understanding the possibilities and probabilities. They are likely following hype and acting instinctively on greed.

Accelerators and incubators deal with an enormous about of uncertainty. While they do a lot of research into markets and interview founders to get a good sense of future states, the nature of very early stage is that the probabilities of these possibilities are largely unknown. As a hedge against uncertainty, accelerators often invest in a greater number of opportunities than VCs.

VCs start moving into the risk zone especially when the probability of a founder’s vision (i.e. proposed future state) becoming reality increases with market traction.

Understanding of future states and probability can be drawn from personal experience, deep expertise or education (i.e. doing a lot of research or talking to experts). Traction (i.e. customer adoption) is the most effective way to demonstrate favorable probability. And the degree that traction matters depends on the type and background of the investor (accelerator vs VC; ex-banker vs former founder). The more comfortable the investor is with using his own expertise and experience, the less he needs to rely on traction.