How Business Models & Core Competencies Drive Competition: The Metaverse David + Goliath

Last week I covered Facebook's plans for the Metaverse. Today we're turning our eyes to Snap. It started with an interview (sorry it might be paywalled) that The Information did this week with Konstantinos Papamiltiadis "KP", Snap’s new VP of platform partnerships. The phrase that piqued my interest was “Snap has no plans to invest in what’s being called the metaverse.” Strong words indeed. I knew I had to map this one out.

Mind mapping allows me to pull apart every notable detail and analyze them piecemeal before stepping back to see the big picture. This is how I approach business strategy. So today I’m going to dissect Snap's partnership strategy, why it's not hopping on the Metaverse bandwagon, and how this will affect the future of tech platforms.

What's Platform Partnerships?

Platform partnerships means different things to different industries so let's first break it down in the tech context.

Before joining Snap, KP spent 9 years at Facebook in the same role. According to Variety, he turns products into scaled platforms. The difference between a product and a platform is that a product is a 1st party app that's owned by a company. All its features are developed by that company. On the other hand, a platform's features can either be made by the company that owns it or by 3rd party developers and content creators, aka partners, that build on top of it in return for money and reach.

In our current Web2 paradigm, platforms are the most common way for us to access the Internet. Facebook, Google, and Amazon are all platforms for social media content, websites, and ecommerce respectively, where suppliers are aggregated for the convenience of users to discover and access. Each of these proprietary systems are inherently closed gardens because each company has financial incentive to retain user data to improve their services.

For a product to become a platform, it needs to build an ecosystem and incentive structure composed of:

Partners: to make the content.

Tools: to make it easy for partners to make said content.

Distribution: for users to access the right content at the right time to increase engagement, spend, or sharing (which could lead to more users joining the platform).

The most common way for us to access the Internet today is through closed platforms

KP's job, then, is to increase the quantity (aka scale) and engagement of partners that participate in Snap's platform. The only thing is that Snap’s platform isn’t a walled garden, which opens up some very interesting partnership opportunities.

The Catch 22 of Business

To understand where Snap's going, we first need to understand its nature through its business model and core competencies.

Business model: the way it makes money.

Core competencies (CC): a company's DNA and strengths.

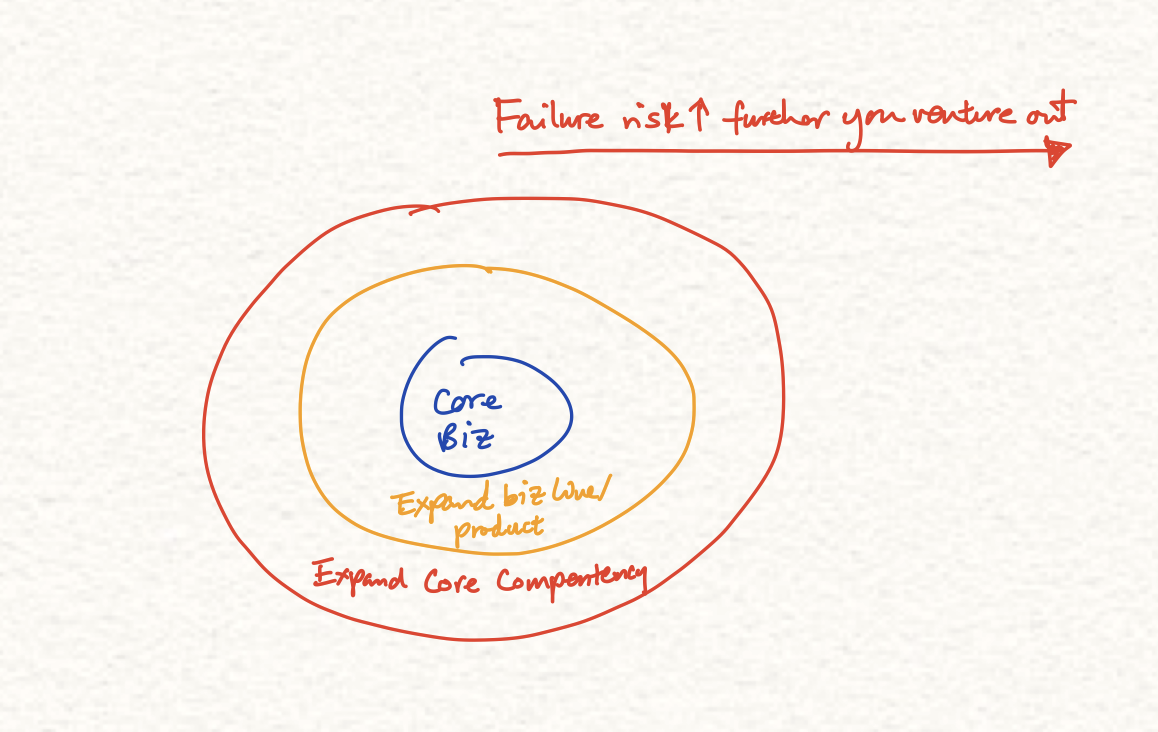

A business is, for better or worse, a slave to its nature and we can use this knowledge to help us predict how they will behave in the future. In general, the further a company gets away from its core business and competencies the more likely its endeavors will fail. This is similar to how we as individuals expand our comfort zones over time. Each time we learn a new skill or encounter an unknown situation, there's a learning curve and discomfort to overcome.

The difference is that in the market, there are competitors trying hard to eat your lunch and growth is measured in profits. Yet if the company remains within its comfort zone, it'll eventually become obsolete anyways. That's the catch 22 of business.

The most common way for a company to expand outside its comfort zone is to create a related business line either in-house or by acquiring other companies. The new business still retains the core strengths and attributes of the parent company while expanding the number of customers (aka user base) or increasing the revenue from the same customers (aka average revenue per user or ARPU).

Even more daring is expanding its core competencies to respond to existential threats or reinvent itself to take on massive opportunities. Below is how I see Snap and FB/Meta expanding their business lines and competencies.

Facebook’s strengths include scaling, sucking up user data, and ads targeting (an over simplification but you get the point). Their adjacent expansions include Instagram and Whatsapp which plug in relatively seamlessly with FB’s existing infrastructure. The same can be said of Snap’s Bitmoji acquisition and social gaming moves as they’re part of the Snapchat app experience. For FB, going into IRL realms like events and dating has a higher level of failure, as is trying to make hardware.

Perhaps the biggest transition of all is towards next generation computing platforms like the Metaverse. For Meta, this means building hardware, vertical integration, and even the rebranding itself. For Snap, it's a matter of figuring out useful AR applications, attracting partners to enhance the Snapchat experience and sharing its AR capabilities beyond its own walls. Meta has time and scale, whereas Snap uses its lack of scale to its advantage.

Facebook's 10-Year Moonshot vs Snap's Scrappiness

Facebook/Meta saw the potential of the Metaverse coming a long time ago. 7 years to be exact when it acquired Oculus in 2014, then barely more than a Kickstarter project, for $2.3B. What followed was the first explosion, or second if you count that 90's blip, of devices, apps, and investment money into the VR space. I covered the last wave when working in venture capital back in 2016, and realized it was a space that was to stay once Facebook got into the fray.

I think we are still years away from a Metaverse that's ready for the masses, but it's precisely why Meta took its time slowly ramping up efforts to build up new core competencies (hardware know-how, physical goods and digital content distribution, developer relations). Time is an even more valuable because it's not yet clear which competencies are necessary for success in the Metaverse. This is the same trial and error discovery process that every current Metaverse company is going through.

Meta also has the advantage of scale and cash. Combined with its propensity to copy innovative features from other products, it can afford to simply sit back, let other companies take risk of discovery, and become a rapid second mover. It’s choosing instead to focus on deep R&D and infrastructure investments that are hard to replicate.

Snap is taking a different route, having come 7 years after FB's founding, and only recently found its financial legs [insert link for wall street sentiment]. Since it has far more to prove in the market (and much less cash than Meta), it can't afford to try out long term big projects to develop new competencies. But what it lacks in scale, it makes up with a bold experimental culture and leveraging its small size wisely with an open platform.

Snap can afford be more risky in trying out new features when failures won’t impact billions of people. Combined with a genuinely scrappy culture, this allows Snap to do publicity stunts like Spectacles vending machines, quickly shipping major app changes, and claim nutty stuff like being "a camera company" on its S1. At Snap's first Partner Summit in 2018, I saw first hand how closely it works with partners to execute small but highly polished experiences like Landmarkers.

The building-scale AR filter Landmarkers was launched to only five locations rather than a large scale deployment.

Snap's small size is also a huge advantage when it comes to partnering with companies that are weary of Meta's power and reach - which honestly is just about everyone these days. Apps like Viber, Bumble, AllRecipes would normally hesitate working the likes of Meta or Google, have instead chosen to jump into bed with Snap. The company is at a Goldilocks size of being just big enough to be respected, but small enough not to be feared.

Each of these partnerships demonstrates a different objective for Snap. Viber, another messaging app, expands Snap's AR experiences into Asia and Eastern Europe where Snap has very little presence. Bumble opens a completely new use case (dating) as well as a loose network of strangers that's opposite from the close friend networks found on Snapchat. AllRecipes creates an avenue for Snap's AR search functionalities to be both useful and be improved with food-specific training data.

Most recently, its partnership with Google on the Pixel 6 provides a precedent for further integration with a powerful mobile OS and device maker down the road. All these alliances have one thing in common: they're either afraid of Meta or actively competing against it.

Snap has a more open platform compared to Meta because it integrates its capabilities into other apps.

Snap's platform is open because it allows other apps to take advantage of the AR and social capabilities it's already built for Snapchat. This approach further pushes Snap into a technology provider position, which improves its optionality and odds of survival in an unpredictable future. In other words, if you sell picks during a gold rush, you’ll never go out of business regardless of whether you strike gold yourself. To be a tech provider is to be a pick seller.

Why isn't Snap building the Metaverse?

In short, Snap doesn't own the term "Metaverse". Meta does. In nascent industries, it's often a fight over mind share, not just market share simply because the market doesn't exist yet. Each industry player is building the future through engineering and science while simultaneously flaunting its expertise and vision to inspire investors, partners and users and differentiate itself from the competition. This means the battle is fought not only along product lines, but also over the ownership of terms and buzzwords.

Over the 4 years of running biz ops at Sturfee, I saw many terms for what we now call the Metaverse come and go. The AR Cloud, spatial computing, the spatial web, Magicverse (thanks Magic Leap ), persistent social ubiquitous blah blah AR/VR/MR/XR (the dreaded R's!). All these buzzwords were coined by companies hoping that their term will catch on and become household names for their target audience.

I remember launching our first SDK at Sturfee, who btw creates pretty awesome country-scale computer vision tech, and debating with the founders on what to call the product. We settled on Visual Positioning Service (VPS) because the term AR Cloud was "owned" by the brilliant Matt Miesnieks (who was then the CEO of 6D.ai and later acquired by Niantic Labs). In effect, by using the term AR Cloud, we would be following another company's paradigm rather than crafting our own. Ironically, Google announced their own VPS the following month at its annual I/O developers conference, which forced a whole new cascade of repositioning for us - lol’s of business.

Since words influence our frame of thought, we should be conscious of where key terms come from and the incentives of their originators. Each time we talk about the Metaverse, what exactly are we referring to? Is it Facebook's vision of it, the Snow Crash version, or a catchall word for AR/VR (per Wikipedia's definition). The way we think about the Metaverse will have an impact on what we expect of it, and ultimately how we build and participate in it.

Lastly, it's somewhat of a strategic credit for Snap to deny its role in the Metaverse since its core competencies lie solely in AR. Without VR or strong hardware capabilities, it's not that Snap won't build the Metaverse, it's that it can't. So rather than playing into Meta's game, it chose to use this opportunity to further differentiate itself from the competition. It’s not a bad plan, as it can help rally allies who oppose Meta’s vision.

How Will this Shape the Metaverse?

To gauge the future, it helps to list the known variables. In this case, it's Meta furiously building its version of the Metaverse, which seems to be an extension of the current Web2 closed platform paradigm.

I thought this excerpt from an (otherwise lackluster) interview with Neal Stephenson, the genius sci-fi writer who 30 years ago coined the term "Metaverse", to be insightful:

"What’s actually being built is fundamentally different from the Metaverse of the book in a few important ways — particularly the revenue model.

The revenue model — the way that the makers of the system make money — is more important than anything else because it drives the technical features."

While no one can exactly predict what Snap will do (not even Snap itself), its open approach to ecosystem building, lack of vertical integration, and positioning as a technology provider could make it a prime candidate for serving a similar role in the open Web3 world, as long as the revenue model works out.